From the article:

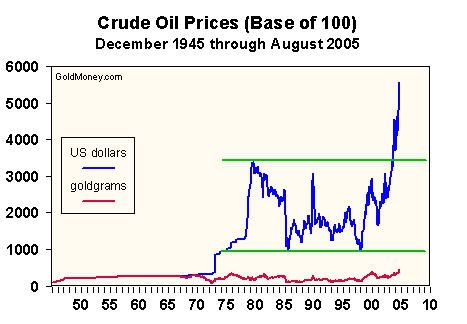

"This chart presents a base 100 analysis of crude oil prices in terms of dollars and grams of gold, i.e., goldgrams. In other words, to establish the useful comparison depicted above, this analysis assumes that one barrel of crude equals $100 and 100 goldgrams as of December 1945, and then calculates the month-end price thereafter based on the actual dollar price of crude oil and the prevailing dollar-to-goldgram rate of exchange.

We can see that the price of crude oil in goldgrams is essentially unchanged throughout this period. So it is clear that gold communicates economic value very effectively, which is the primary feature of money. Because money is the tool upon which economic activity is based, which is a reality that therefore makes money central to society, money is not barbaric. Consequently, gold cannot possibly be barbaric because gold is money.

Nor is it a relic because gold communicates value today as effectively as it did fifty years ago, and much better than the US dollar, which is a point made clear by the above chart. In contrast to today's national currencies, gold tends to hold its value, or in other words, its purchasing power remains relatively unchanged. In fact, this precious attribute of gold is timeless because the aboveground stock of gold grows approximately at the same rate of world population growth and new wealth creation.

So how could anything so valuable and useful as gold be barbaric? And because gold is as useful today as it ever was, how could it possibly be a relic?

This gold pejorative is readily attributed to Keynes. But here is what he really wrote in 1923 in A Tract on Monetary Reform: "…the gold standard is already a barbarous relic."...

...Note that it is not gold that is the barbarous relic, but rather, Keynes is taking aim at the gold standard. There is a very big difference here. The gold standard is the mechanism by which national currencies at one time were defined as weights of, and redeemable into, gold.

Though the United States continued to define the dollar in terms of gold when Keynes penned those now infamous words, it had become the exception. Most of Europe had stopped the redeemability of paper currency into gold with the outbreak of hostilities in 1914. What's more, after the war European countries were slow to return to the gold standard because their currencies had become terribly debased by the expansion of credit and the concurrent printing of money that had occurred over the intervening years.

In effect, by the 1920's the classical gold standard was essentially dead, which was the reality observed by Keynes. It was dead because banking interests, working hand-in-hand with governments, killed it. They killed it because governments wanted more money to meet their growing spending aspirations, and seeing the profit opportunity this circumstance presented, bankers wanted to lend it to them. The discipline of the classical gold standard prevented the unbridled extension of credit and the resulting creation of new money, with the result that it had to go. So is that why the gold standard had become a 'barbarous relic'?