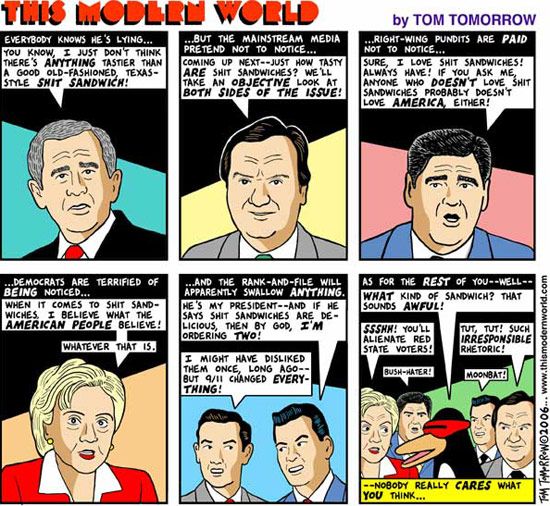

To watch the cops and the corporate media get busted lying and covering up the police's illegal, unconstitutional, and morally irreprehensible chemical warfare (pepper spray is a chemical weapon) against peaceful demonstrators exercising their constituitional rights click the image abover or Here:

You have really got to be a mind-controlled zombie robot cop to take orders that are OBVIOUSLY unconstitutional, morally irreprehensible, and without a doubt will result in injury (and potentially the death of) inocent women and children. HEY COPS: This is why good honest decent people don't like you!!!

-Etienne